School funding is complex. We’ve tried to share key basics here to help the community understand terms and how school funding works.

We also have the school funding guide we created in the spring 2024 to provide school finance highlights in a more graphic way. There’s the 8.5×11 size and a mobile-size.

Information To Know About School Finance

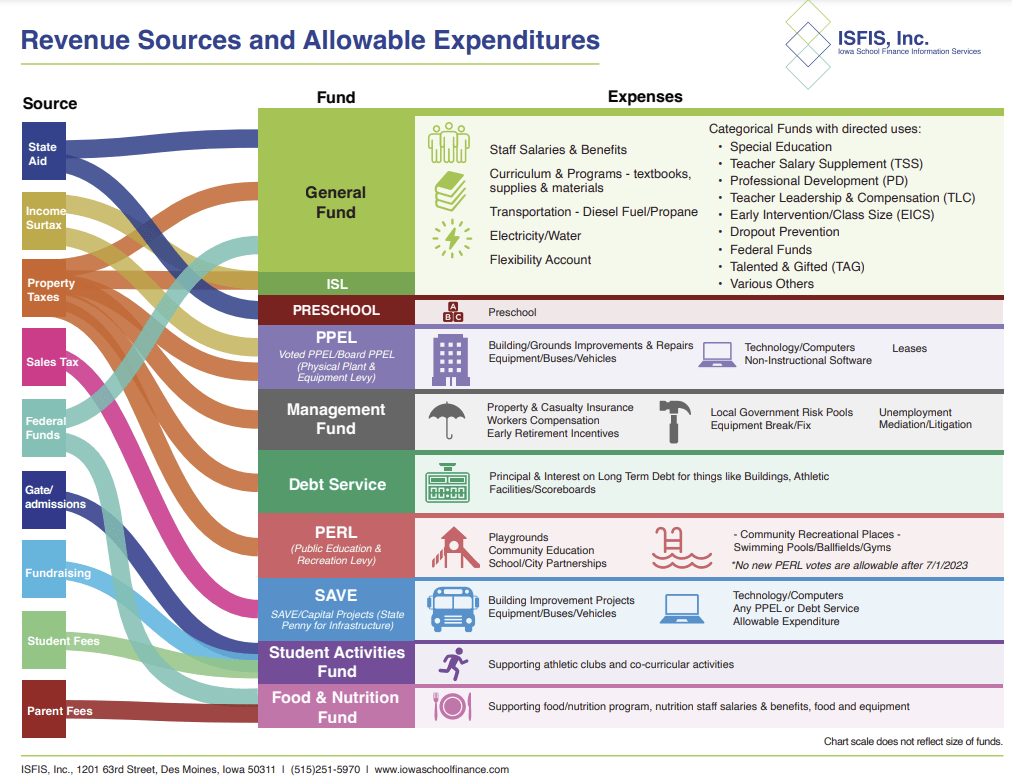

- Funding “Buckets” have restrictions. The General Fund (GF) is for funding the educational program. State/federal law/rules dictate allowable expenditures, even within the General Fund. Levies can also only be used for specific purposes. For example: A school may have money to buy a scoreboard or pave a parking lot but not enough for more teachers (or vice versa). These restrictions also apply to other expenses within our school district. For example: the Elementary School may need to fundraise to host STEM Night since food can’t be paid for out of the general fund. Or may need a financial backer for PBIS initiatives since these items are deemed “extra”, even if staff members feel like these items are critical to student success.

- Enrollment is key to a district’s long-term financial health. The General Fund using an enrollment-based formula to generate funding per student. Districts are prohibited for levying additional local funds beyond a few specific levies that have a corresponding specific use.

- The General Fund pays for education programs for students and is the largest fund. It still has restrictions on it’s use, as mentioned above. State laws dictate uses for this fund in order to preserve the health of the district.

- The Student Activities Fund (aka the Activities Department) is not/cannot be funded by the General Fund. It is funded through gate admissions, athlete participation fees (if applicable) and private donations by people, companies and/or organizations (like Booster Clubs). A graphic from Iowa School Finance is below showing the various sources for different school funds.

- Schools are labor intensive. Around 80% of a district’s funds are spent paying it’s staff salaries and benefits. This number may increase due to the recent state law that changed teacher compensation minimums.

- Local property tax rate is primarily set by the formula. The school board has limited ability to increase or decrease the local property tax rate.

- Take notice of the per pupil amount set each year. This numbers matters because it is what sets school budgets. The dollar amount is made up of a variety of sources. We’ve shared a graphic of those sources from Iowa School Finance below. If this amount goes up 2% and the district’s overall expenses went up 3.5%, then the district has to find 1.5% of cuts to keep the General Fund in line. The opposite is true too. If the per pupil amount goes up 5% and expenses go up 3.5%, then the district would have 1.5% surplus for extras or future needs. This is why looking the percentages provide important context vs. just looking at total dollars. It is possible to receive a total funding increase in dollars, but not receive enough of an increase to cover the increased costs of the district caused by inflation, legislation, salary requirements, benefits changes and more.

Key Finance Terms

- Enrollment is Key – the General Fund enrollment-based

- Spending Authority – legal limit on GF spending for districts (not amount of cash on hand). All other funds allow spending if cash is available. Spending Authority is akin to a district’s credit card limit.

- Fund Balance – district’s accounting position. Fund Balance is what is left over after taking in all amounts owed to the district and subtracting all amounts owed by the district at the end of the fiscal year. Certified Budget, Monthly Financials, Checkbook/Cash Balance, Certified Annual Report, and Independent Auditor’s Report all relate to Fund Balance.

- Unspent Authorized Budget (UAB) – district’s spending authority position. UAB is what is left over after taking in all spending authority available to the district less all spending used by the district at the end of the fiscal year. School Budget Review Committee and Regular Program New Authority relate to Spending Authority.

- State Supplementary Assistance (SSA) – schools receive an amount per student for the next fiscal year, set by the Iowa Legislature, based on the Oct. 1 enrollment headcount. The increase per student multiplied by the enrollment headcount is known as New Money or New Authority.

- Regular Program District Cost (RPDC) – calculated by taking the district’s enrollment multiplied by the state-authorized spending amount per student.

- Budget Guarantee – mechanism to postpone the budget impact of enrollment decline to the district by one year. If this year’s RPDC is less than 101% of last year’s RPDC, the district receives spending authority needed to get the district to 1% growth (funded entirely with property taxes). The calculation is for one year only and resets the following year.

- On-Time Funding – since enrollment calculations are a year behind, this allows Spending Authority for new pupils that were not in last year’s count.

- Cash Reserve Levy – “Regular Cash Reserve Levy” provides cash to operate the district. “School Budget Review Committee Cash Reserve Levy” funds spending authority granted by the SBRC (primarily special education deficits/on-time funding). Does not create Spending Authority, only the funds to spend.

Funding Graphics

Source: Iowa School Finance Information Services for the graphics, key terms and general information regarding school funding and finance. Visit their website to learn more about school finance in Iowa.

You must be logged in to post a comment.